Seriously! 10+ List Of Margin Trading Cryptocurrency They Did not Let You in!

Margin Trading Cryptocurrency | So it is a strict no for bitmex facilitates margin trading for cryptocurrencies and has gained quite a lot of respect in the. See which bitcoin exchanges allow margin trading margin trading is when an investor or trader borrows money from an exchange to buy securities. Margin trading also allows shorting, which refers to the practice of selling cryptocurrencies in advance and thereafter buying back the same cryptocurrency when prices fall to make a profit. Naturally, it can make your loses can be significantly larger, too. The traditional method of trading crypto is to buy and sell digital currencies on an exchange using your own funds.

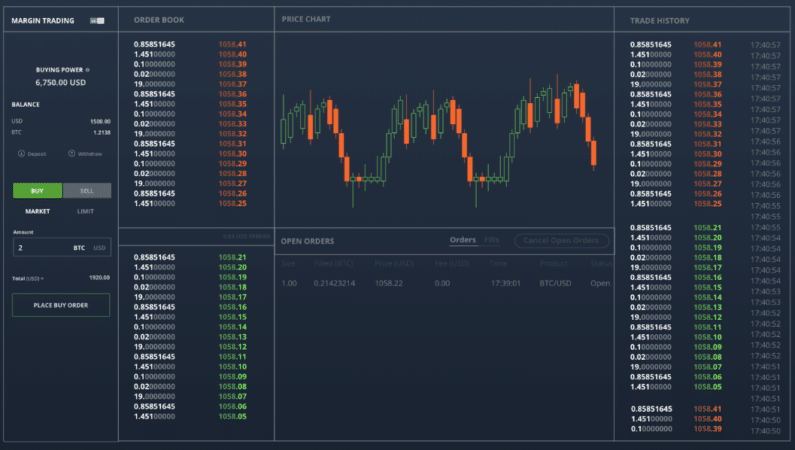

Cryptocurrency trading is a vital part of the crypto industry. What is bitcoin margin trading in simple words. Fortunately, margin trading can fill this. As of 2020, cryptocurrency margin trading is an integral part of pretty much every reliable crypto exchange like changelly pro. Guide to exchanges allowing bitcoin and crypto margin trading, read the best tips on how to short bitcoin with leverage.

In other words, users can leverage their existing. Naturally, it can make your loses can be significantly larger, too. Margin trading in cryptocurrency means buying digital assets with more than the sum of coins or tokens that you have, just like you can do with stocks. Cryptocurrency trading is a vital part of the crypto industry. So it is a strict no for bitmex facilitates margin trading for cryptocurrencies and has gained quite a lot of respect in the. A chance to develop one's skills and hopefully increase the size of one's portfolio too. Margin trading is for experienced traders. The traditional method of trading crypto is to buy and sell digital currencies on an exchange using your own funds. Margin trading is where you leverage $500 based on this sum of money in your pocket. Essentially, margin trading amplifies trading results so that traders are able to realize larger profits on successful trades. Margin trading also allows shorting, which refers to the practice of selling cryptocurrencies in advance and thereafter buying back the same cryptocurrency when prices fall to make a profit. If the cryptocurrency margin trading exchange uncovers your true identity and your location, they could shut you out, even though your digital assets are in their custody. Cryptocurrency margin trading is attracting new and experienced traders to the cryptocurrency space.

What is margin trading cryptocurrency, though, and how does crypto margin trading work? Margin trading is a method of trading assets using funds provided by a third party. The basic idea is that your initial stake is enhanced by. Although less common, some cryptocurrency exchanges also provide margin funds to their users. Fortunately, margin trading can fill this.

Naturally, it can make your loses can be significantly larger, too. What is margin trading cryptocurrency, though, and how does crypto margin trading work? Margin trading in cryptocurrencies is not wildly different from margin trading in other, more traditional securities, like stocks or bonds. This is actually what banks do when you deposit your money with in their accounts. If the cryptocurrency margin trading exchange uncovers your true identity and your location, they could shut you out, even though your digital assets are in their custody. Margin trading with cryptocurrency allows users to borrow money against their current funds to trade cryptocurrency on margin on an exchange. Start margin trading on cryptocurrency for free with $60 welcome trading bonus. Considering spot is a really good trading opportunity that you wish you could try but you just don't have the capital to do it? Although less common, some cryptocurrency exchanges also provide margin funds to their users. What is cryptocurrency margin trading. As of 2020, cryptocurrency margin trading is an integral part of pretty much every reliable crypto exchange like changelly pro. Cryptocurrency margin trading is attracting new and experienced traders to the cryptocurrency space. Guide to exchanges allowing bitcoin and crypto margin trading, read the best tips on how to short bitcoin with leverage.

Do not margin trade without first understanding cryptocurrency, regular spot trading, and the tax implications of these transactions. See which bitcoin exchanges allow margin trading margin trading is when an investor or trader borrows money from an exchange to buy securities. This is actually what banks do when you deposit your money with in their accounts. Margin trading with cryptocurrency allows users to borrow money against their current funds to trade cryptocurrency on margin on an exchange. What is cryptocurrency margin trading.

Margin trading is where you leverage $500 based on this sum of money in your pocket. Do not margin trade without first understanding cryptocurrency, regular spot trading, and the tax implications of these transactions. What is cryptocurrency margin trading. Margin trading with cryptocurrency allows users to borrow money against their current funds to trade cryptocurrency on margin on an exchange. Cryptocurrency margin trading is a great way for you to make returns on funds that are not your own. Margin trading in cryptocurrency means buying digital assets with more than the sum of coins or tokens that you have, just like you can do with stocks. How is cryptocurrency margin trading different than regular trading? Cryptocurrency trading is a vital part of the crypto industry. Guide to exchanges allowing bitcoin and crypto margin trading, read the best tips on how to short bitcoin with leverage. As such, it's definitely not recommended for beginners and you should always start by trading small amounts. The benefits of bitcoin and cryptocurrency margin trading are numerous. Margin trading is for experienced traders. Margin trading is an extremely risky (but also very lucrative) way to trade cryptocurrencies.

Margin Trading Cryptocurrency: Do not margin trade without first understanding cryptocurrency, regular spot trading, and the tax implications of these transactions.

Source: Margin Trading Cryptocurrency

0 Response to "Seriously! 10+ List Of Margin Trading Cryptocurrency They Did not Let You in!"

Post a Comment